How It Works

PUT IN ANY TOPIC

Pick 15-20 of The Exact Experts for a 4-Day,

Design-Thinking Forum, And Publish Reports and Content

Design-Thinking Forum, And Publish Reports and Content

-Then-

PRIVATE:

Own the Valuable Insights

-or-

PUBLIC:

Brand It, and Make It Available for Others to Buy

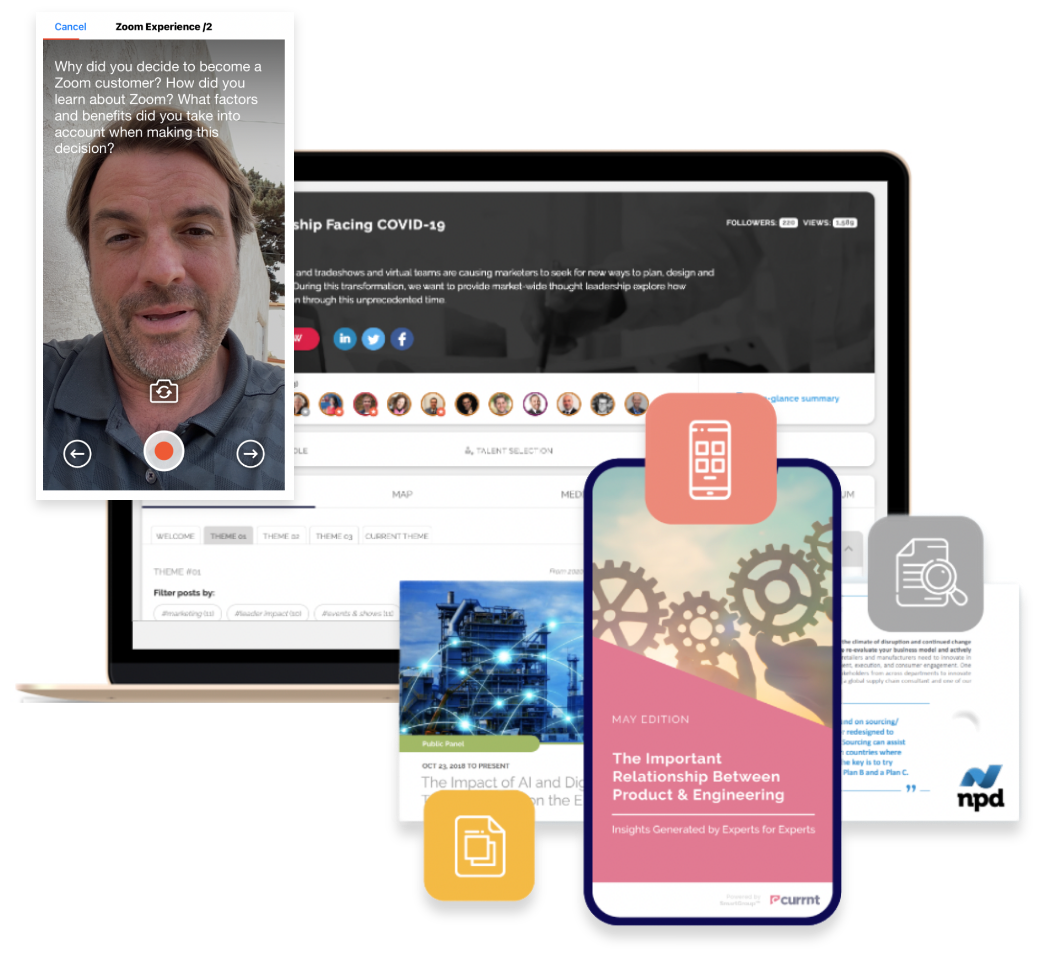

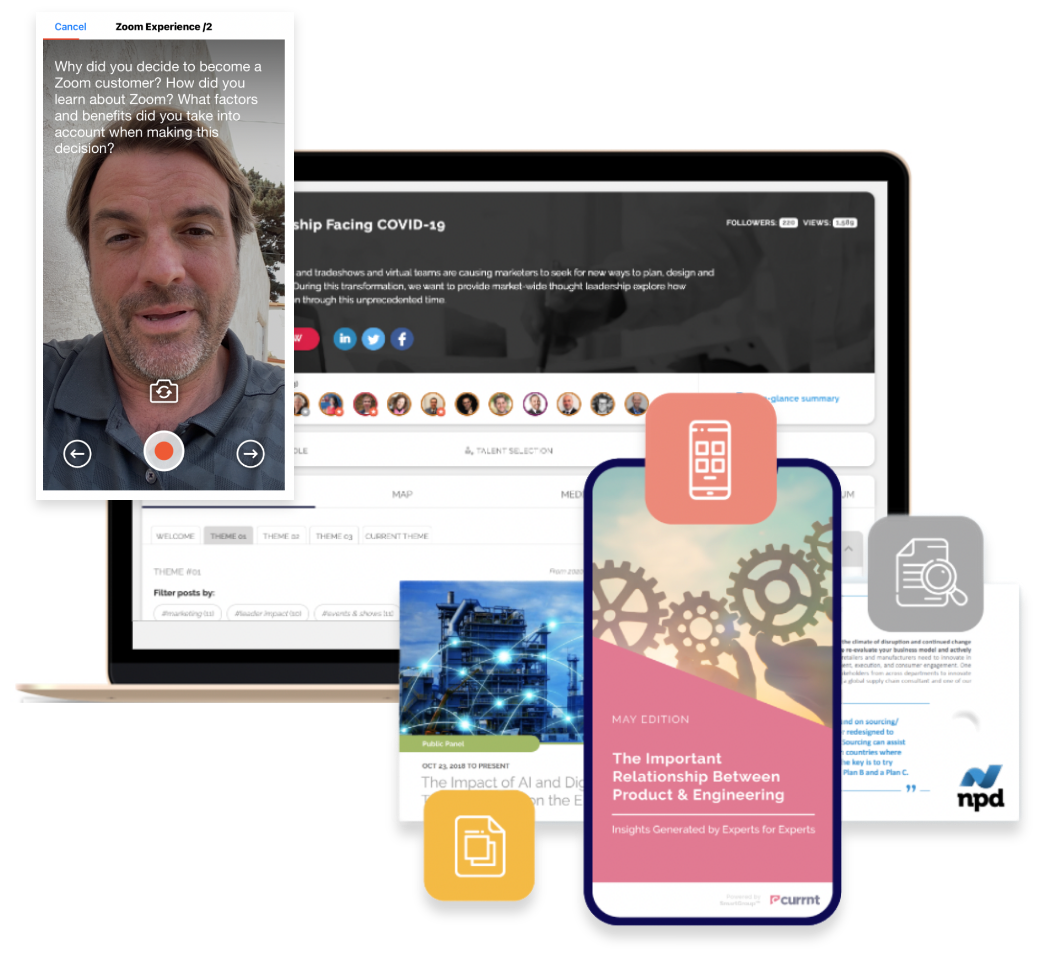

Get Inspired

See All That You Can Do With Currnt

Used By The Most Relevant Organizations

A COPILOT FOR ROBUST ENGAGEMENT

AI augmented facilitation and expert participation.

Gamified to reward those that add value, not noise.

MENU

A DOZEN OF OUTPUTS INCLUDED IN

EACH ENGAGEMENT

EACH ENGAGEMENT

4 Webinar style live readouts with SME facilitators

4 Executive Summaries Slides

4 Premium Pieces of Content

Social Posts

Ebooks

Blogs

Podcasts

1 Final Report

Optional: Custom White Papers and Infographics

CUSTOM BRANDED REPORTS AND CONTENT

Freshest quotable voices fuel compelling insights and storytelling

AI + professional writers make quality branded outputs in just hours, not days

Still Not Sure, Request A Demo

Join the Fresh Knowledge Movement

The best way to predict the future is have a

hand in creating it

hand in creating it

What:

KnowledgeStream™

Headline:

Grant Thornton & Gyro Driving Agile Voice-of-Market and Iterative Insights For Their Business Strategy

"We believe that every CMO in B2B needs a continuous ‘market feedback loop’. Currnt gave us an ongoing, firsthand experience with the exact groups of people for our client. This moved us upstream in our relationship with our client and shaped their vision for the future business."

Adrienne Houghton

Strategy Director & Grant Thornton Account Director at Gyro

Challenge

For Gyro, a leading B2B global marketing agency, needed to enable their client, Grant Thornton, a top consulting and accounting firm, to stay relevant to their target market on an ongoing basis.

- Sourcing and engaging C-level executives who are often difficult to engage

- Creating a virtual, ongoing practice that provides a steady stream of insights and thought-leadership

- Keeping cost and overhead low

Use Case

The Gyro & Grant Thornton teams created a top notch Virtual Market Advisory Board covering a range of 150+ C-level personas with the help of Currnt’s AI enabled platform.

- Covered 48+ two-week research topics

- Impacted 6 industry solutions

- Drove VoC empathy into leadership teams

- Impacted business strategy and time to market

- Enabled regular experiential learning and direct market engagement for executive leadership

What:

KnowledgeStream™

Headline:

Medicure Drives Iterative Insights For Agile Product-Market Fit

"Having run KOL practices for 25 years at P&G, I know the challenges to keeping them constantly maintained, while also trying to drive insights and ROI for the business. Currnt.com is getting my teams learning firsthand from the market and impacting our product and go-to-market strategy for our product portfolio."

Kevin Taylor

VP Commercial Operations at Medicure

Challenge

Medicure needed a practice that could align both product and commercial teams while generating ongoing research to shape their go-to-market strategy for multiple product lines.

- Creating a hands-on experience for teams to engage firsthand with target market

- Aligning cross-functional teams with the needs of their market

- Finding alternatives to costly and timely in-person dinners

- Replacing a range of online activities that did not yield reliable impact

Use Case

With the help of Currnt’s AI enabled platform Medicure created a top notch Virtual Market Advisory Board covering a range of Health Care Key Opinion Leaders (KOLs) personas.

- Built a scalable practice of continuous, firsthand engagement

- Discovered trends & challenges of key stakeholders

- Iterated on marketing materials, messaging, and product roadmaps

- Drove GTM strategy for heart failure devices & cardiovascular therapeutics

- Created new experiential learning opportunities for cross-functional teams

- Enabled new customer relationships for sales

What:

KnowledgeStream™

Headline:

Sprinklr Drives Voice Of Market, Thought Leadership & Demand Gen

"Currnt helps us solve for multiple problems. Not only are we engaging directly with our market on subjects driving the industry, but we’re also getting content to fuel our marketing, new leads for our sales teams, and an experience helping us better focus on the customers’ problems - without causing additional work."

Yoli Chisholm

VP Marketing at Sprinklr

Challenge

Sprinklr, the leading social media management software for enterprises, wanted to own the CMO narrative and create thought-leadership and demand generation.

- Needed a hands-on experience for their teams to directly engage with the target market

- Live events consumed too much time and budget

- Range of virtual activities were not yielding reliable impact

- Needed a practice that could integrate with a range of other marketing functions

Use Case

Currnt’s AI-enabled platform rapidly recruited 200+ CMOs and other senior marketing leaders for an ongoing Virtual Market Advisory Board, fitting to Sprinklr’s exact needs.

- Provided rapid 1-week recruitment of experts and a steady stream of new applicants

- Covered 24 topics/studies related to the future of marketing

- Produced 100+ VoM content outputs to fuel content marketing calendar

- Generated 500+ followers and customer leads with direct CRM integration

- Delivered bi-weekly executive summary readouts for cross-functional learning

What:

KnowledgeStream™

Headline:

Salesforce Wins Strategic Client Acquisition

"The insights were absolutely needed to get all of our leadership on board. Not only did we love the experience, but it aligned our strategic goals and gave us the missing data to justify the right decisions."

Nkobi George

VP Technology Programs at AARP

Challenge

Salesforce wanted to win an RFP it submitted for AARP, but needed to knock out three big competitors.

- Required a way to differentiate themselves and improve chances of winning the business

- Wanted to meet the goal to transform AARP’s customer experience

- Needed to leverage best-in-class digital technology that serves existing and future members

- Wanted to show noticeable proactive steps to the future client

Use Case

Currnt’s AI-enabled platform rapidly recruited a 30+ Virtual Expert Advisory Board to validate AARP’s need for their digital transformation roadmap and investment in Salesforce.

- Delivered bi-weekly engagement and summary readouts

- Produced steady flow of branded content deliverables

- Enabled new business relationships between both companies

- Validated the need of AARPS digital CX transformation

- Resulted in a $2m new client deal

What:

DesignSprint™

Headline:

Schneider-Electric Accelerates Time-to-Market with Rapid Market Insights Affordably

"As a solutions offering team, we have a hard time reliably hearing from our target personas, let alone quickly and affordably. Currnt allowed us to curate a panel with hard-to-reach people that produced stronger insights in weeks than months of our consulting alternatives. With this speed and ease, we can break the log jam of projects and make our teams far more agile and innovative."

Chris Roberts

Healthcare Solutions Architect at Schneider Electric

Challenge

Schneider-Electric wanted to close knowledge gaps and gain a deeper understanding of Healthcare customer needs related to safety management and compliance considerations.

- Needed a unified and transparent customer insights approach

- Required fast turn around and decision making

- Needed to involve a broad group of global SE stakeholders

- Find a digital alternative to traditional consulting

Use Case

Currnt’s AI-enabled platform rapidly recruited scores of industry experts to engage in a Virtual Design Sprint, closing knowledge gaps and providing actionable recommendations.

- Final branded report and dialogue transcript delivered 2 days after conclusion

- Spent 1/4 of the cost of traditional consulting alternatives

- 2 weeks vs. 6 months completion

- Enabled significant acceleration of innovation pipeline

- Aligned product, marketing, and sales stakeholders

What:

DesignSprint™

Headline:

3-D Printing In Healthcare: Deloitte Delivers Better, Faster, More Affordable Expert Insights

"Deloitte teams love Currnt because it allows us to access experts at scale in order to understand market trends, explore new offerings and/or validate critical key assumptions in just days. When it comes to rapid expert insights, Currnt is our go to partner."

Balaji Bondili

Head of Deloitte Pixel

Challenge

Deloitte’s client, a Fortune 500 American health care company, wanted to determine the best business model for entering the 3D printing market for orthopedic joint replacements.

- Deliver against an extremely tight and ambitious timeline

- Wanted a diverse group of hard-to-reach Healthcare and 3D printing experts

- Client sought a more dynamic and collaborative approach to validate product concepts

Use Case

In 2 days, Currnt’s AI-enabled platform rapidly identified scores of target experts to engage in a Virtual Design Sprint, enabling Deloitte to determine the best business model for their client.

- Generated 450+ key insights by experts within 4 days

- Delivered consulting-grade report and dialogue transcript 2 days after conclusion

- Enabled Deloitte to determine best strategic option from 5 initial hypotheses

- Accelerated time-to-market with actionable recommendations for the client

- Enabled Deloitte to understand various stakeholder needs

What:

DesignSprint™

Headline:

Pharmaceutical Manufacturing: On Demand Custom Research Saves The Day

"Companies like Johnson & Johnson have a large research budget. It was worth trying Currnt given the competitive price and relatively low risk. Quality experts, plant managers, upstream and downstream supply chain people, regulatory - it’s what helped us have such a rich conversation. I got the same results as others had gotten with traditional research, but for 10% of the cost and one-sixth of the time."

Antoine Eloi

Sr. Manager, Strategy & Transformation, Supply Chain at J&J

Challenge

Johnson & Johnson’s pharmaceutical arm Janssen Supply Chain had an urgent custom research project and needed to understand key considerations for the future of pharmaceutical manufacturing.

- Needed a super quick three-week turnaround

- Prior research firms would take months to generate needed insights

- Spending hours of research themselves daily was out of question

Use Case

Within days, Currnt’s AI capability rapidly assembled scores of target experts to engage in a virtual design sprint for J&J and provided high value and volume expert contributions.

- Generated 600+ contributions distilled into 5 future scenarios

- Delivered branded presentation for the executive board

- Accelerated Time to Market with only 2 weeks turnaround time

- Avoided high cost of traditional consulting and research firms

- Generated custom research for future decision making

- Saved 30+ employee hours

What:

DesignSprint™

Headline:

Research For Product Design & Manufacturing: Rapid Problem Solving, Vetting And Validation

"The Currnt Design Sprint was a very efficient way to quickly connect with underwear industry experts, allowing us to significantly increase our understanding of best practices, tools and trends in the female underwear industry, which has already helped shape our FEI program."

Mario Alonzo

Section Head R&D-Baby Care FEI

Challenge

P&G wanted to redesign and introduce new qualities to absorbent pads for the middle-aged women experiencing incontinence and needed insights from experts in adjacent industries.

- Difficult access to experts in adjacent industries

- Quickly understand market and consumer trends

- Identify new product and process improvements

- Design actionable product roadmap and technical methods

Use Case

In just two days, Currnt rapidly assembled industry experts in production, manufacturing and design to help craft an informed new product plan tailored to the specified target market.

- Delivered extensive report and dialogue transcript two days after conclusion

- Actionable insights immediately shaped product roadmap

- 1/4 of the cost of traditional research alternatives

- Accelerated Time-to-Market from 6 months to only 2 weeks

- Aligned internal client stakeholders from R&D to Marketing

close